Short term stock tax calculator

There are short-term capital gains and long-term capital gains and each is taxed at. Capital Gain Tax Calculator for FY19.

2022 Capital Gains Tax Rates By State Smartasset

Enter the number of shares purchased.

. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. Investments can be taxed at either long term. Long term gains are taxed at 15 for most tax brackets and zero for the lowest two.

A short-term capital gain results from the sale of an asset owned for one year or less. While if you hold that property or stock. Do Your Investments Align with Your Goals.

Ad Our Resources Can Help You Decide Between Taxable Vs. The calculator on this page is designed to help you estimate your. The Stock Calculator is very simple to use.

The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This calculator reflects the Metro Supportive Housing Services SHS Personal. Any short-term gains you realize are included with your other sources of income for the year for tax purposes.

Short term capital gains. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Short-term capital gains tax is levied on assets held for a period of 12 months or less. For individuals looking to invest in short term. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Look Beyond Traditional Cash Explore PIMCOs Short Term Strategies. Collectible Assets such as coins metals and fine art are taxed at 28.

Short-term capital gains that fall under Section 111A. The above-stated rates and calculator can be applied to most assets however there are a few exceptions to the rule. Do Your Investments Align with Your Goals.

Short-term capital gains that fall do not fall under Section 111A. While long-term capital gains are generally taxed at a more favorable rate. 100000 at a NAV of.

Just follow the 5 easy steps below. Capital gains taxes on assets held for a year or less correspond to. Ad Learn How Shortening Duration Can Help Reduce Interest Rate Risk Limit Volatility.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Find a Dedicated Financial Advisor Now. Calculate LTCG Long Term Capital Gain Tax on sale.

A rate of 15 will be. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income.

Enter the purchase price per share the selling price per share. Thus the total tax liability for Ms Agarwal including taxes on STCG is Rs. Ad Learn How Shortening Duration Can Help Reduce Interest Rate Risk Limit Volatility.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Short-term capital gains that fall under Section 111A. Short-term and long-term capital gains tax.

Suppose Amit had invested in debt-oriented mutual funds in April 2016 and the investment amount was Rs. 158444 for the year 2018-2019. So if you have 20000 in short-term gains and earn 100000 in.

Short term gains on stock investments are taxed at your regular tax rate. Calculate Short Term Capital Gain and Long Term Capital Gain if Equity MF purchased after 31012018 with Tax. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Look Beyond Traditional Cash Explore PIMCOs Short Term Strategies. Find a Dedicated Financial Advisor Now. Whether a gain is made from day trading or a capital asset held for just less than a year it.

Illustration of Long Term Capital Gain Tax Calculation. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Local income tax rates that do not apply to investment income or gains are not included.

Wacc Formula Definition And Uses Guide To Cost Of Capital

State Corporate Income Tax Rates And Brackets Tax Foundation

Capital Gains Tax Cgt Calculator For Australian Investors

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

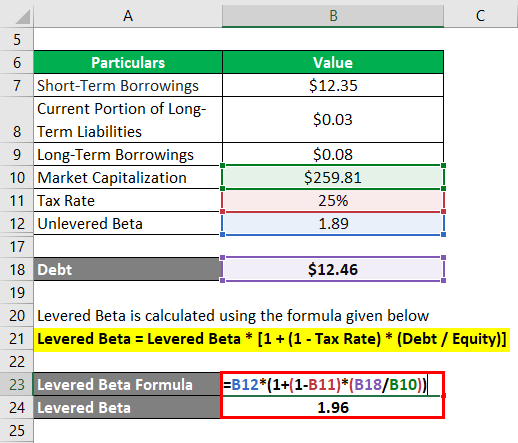

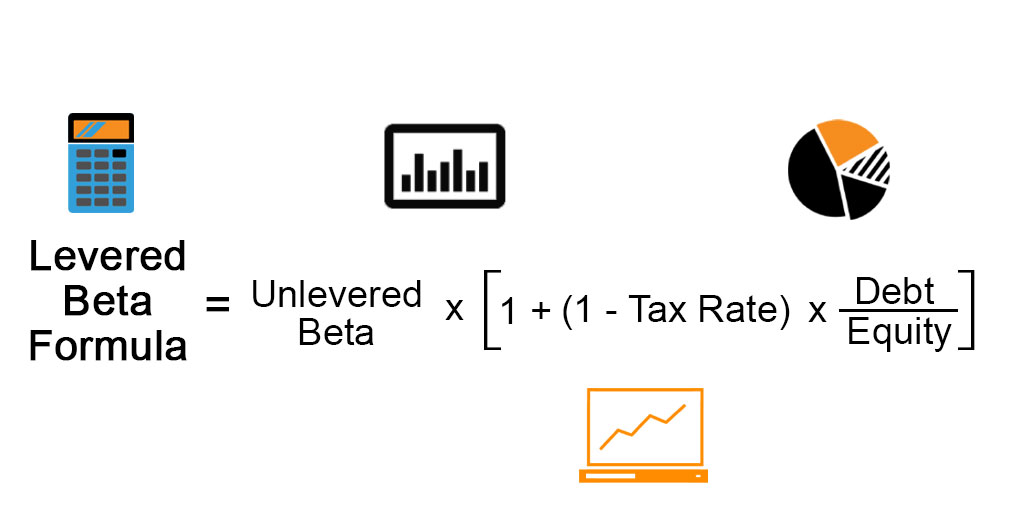

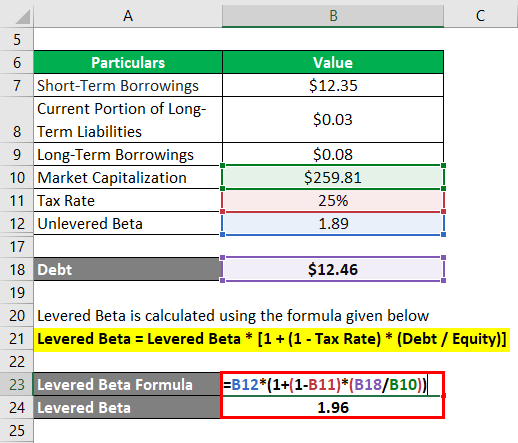

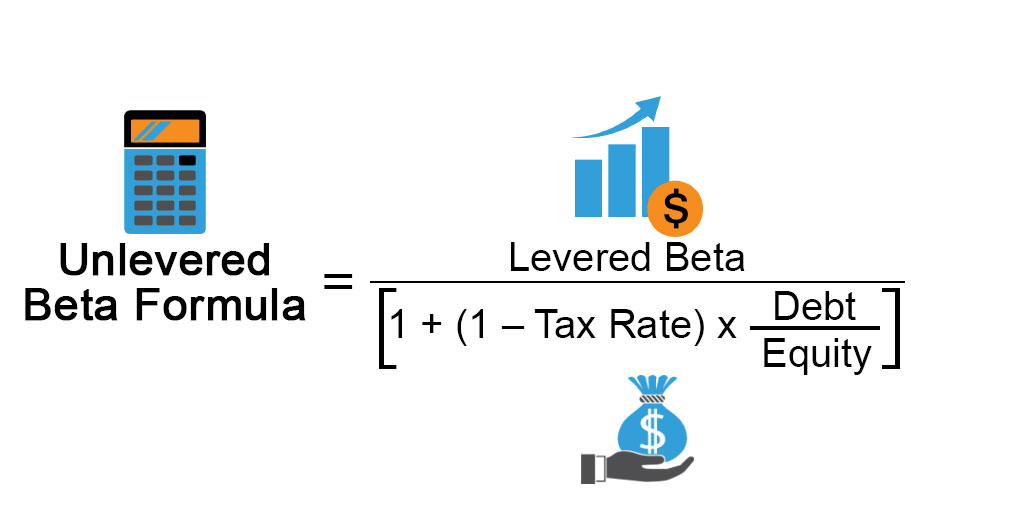

Levered Beta Formula Calculator Examples With Excel Template

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

How Is Your Investment In The Stock Market Taxed Forbes Advisor India

How To Adjust Short Term Capital Gains Against Basic Exemption Limit

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Levered Beta Formula Calculator Examples With Excel Template

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

2022 Capital Gains Tax Rates By State Smartasset

Unlevered Beta Formula Calculator Examples With Excel Template

Understanding Employee Stock Purchase Plans E Trade

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Mutuals Funds Capital Gain Capital Gains Tax

Ltcg Tax Calculation Examples How It Is Done Groww

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet